10 Oct Supplier Segmentation

Supplier segmentation is the foundation for supplier performance management as well as heavily influencing category strategies, and a detailed, up-to-date segmentation can unlock millions of dollars for a large business. Yet, many businesses conduct segmentation as a one-off activity, considering mainly spend or business criticality as a single criterion.

Supplier segmentation is the process of dividing suppliers into distinct groups, based on a set of pre-defined criteria. A famous quote by Rogers from 2009 probably says it best:

“The idea of supplier segmentation is pretty simple – grouping suppliers in a supply base by their impact on the business”

The idea is simple, but the execution may be far from it.

There are a range of reasons why an organization would spend time and effort on segmenting their supplier base:

- Gain insights into supply base

- Identify individual areas of supply risk and total supply risk exposure

- Prioritize suppliers, and determine level of engagement – input to Supplier Relationship Management (SRM)

- Determine optimal types of sourcing events – input to Category Strategies

- Realize significant cost savings through procuring materials and services from the right supplier(s) in the right way(s)

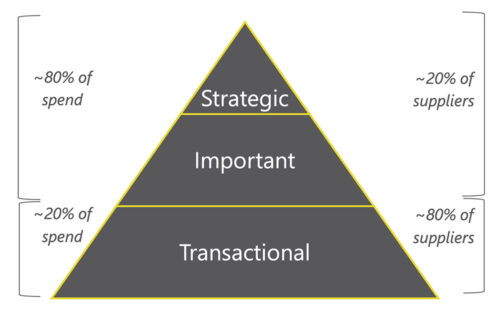

So, let’s review some frameworks, from the simplest to the most complex. Figure 1 below essentially ranks suppliers into three categories based on a selection of criteria. The criteria most typically used are spend and business criticality. The idea is that there is one set of suppliers, the Strategic ones from Figure 1, that should be subject to extra governance (SRM).

This framework is sound, but it is kind of singular in its focus on those suppliers segmented as strategic.

Figure 1: Supplier segmentation (reproduced from Deloitte)

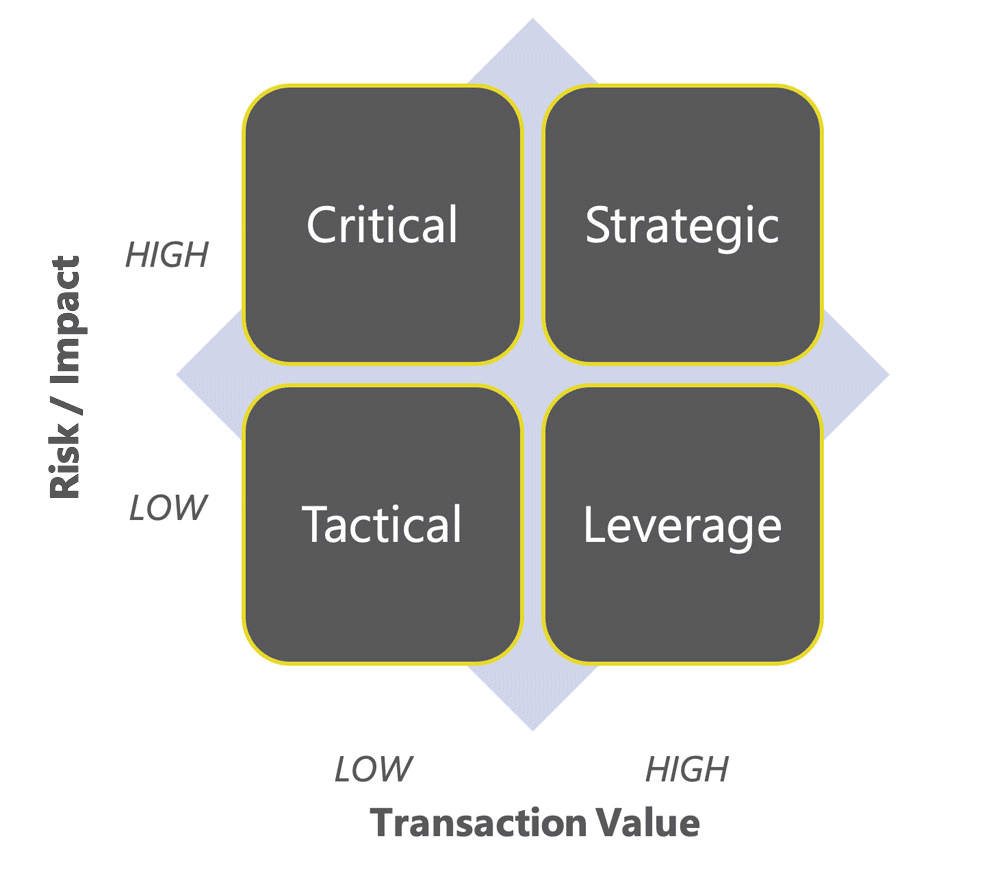

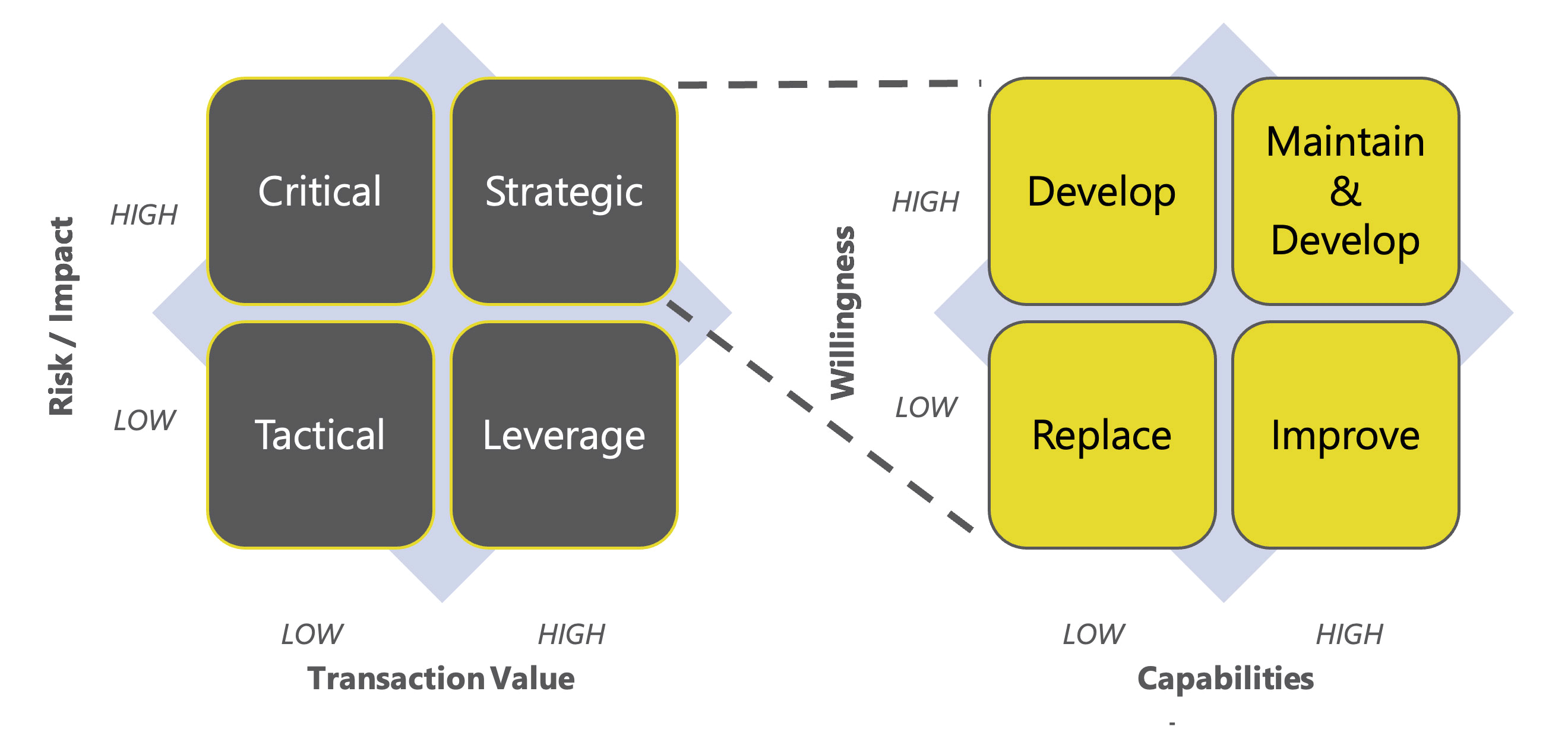

A more comprehensive framework is that shown below in Figure 2, known as the Kraljić matrix or the Purchasing Portfolio matrix (PPM). The criteria that combine for ‘Risk / Impact’ and ‘Transaction Value’ can be very individual for each company, but it is important to state that the result is only as good as the criteria used.

A further issue here is that a lot of criteria that one would like to include in such a segmentation will be qualitative, and information might not be readily available. It is not recommended to use highly subjective criteria, for a number of reasons.

Figure 2: Kraljić matrix / Purchasing Portfolio matrix (PPM)

The interesting thing to notice here is that something like Figure 2 is used to arrive at the segmentation used in Figure 1. However, by condensing the findings into the pyramid shown in Figure 1, attributes are lost.

So, what can we learn from the PPM method of segmentation? Figure 3 below shows high-level key characteristics of each of the four segments, along with some guidelines for each:

| Segment | Description | Guidelines |

|---|---|---|

| Tactical | Many transactions, low value per transaction |

|

| Leverage | Generic items, high volume and high spend |

|

| Critical | Limited volume and spend, but a potential bottleneck |

|

| Strategic | Strategic materials and services for competitive advantage |

|

Figure 3: Kraljić matrix / PPM – segment description and guidelines

This dimension gets lost if the pyramid from Figure 1 is used, so it is recommended to use the PPM as a minimum basis for effective supplier segmentation.

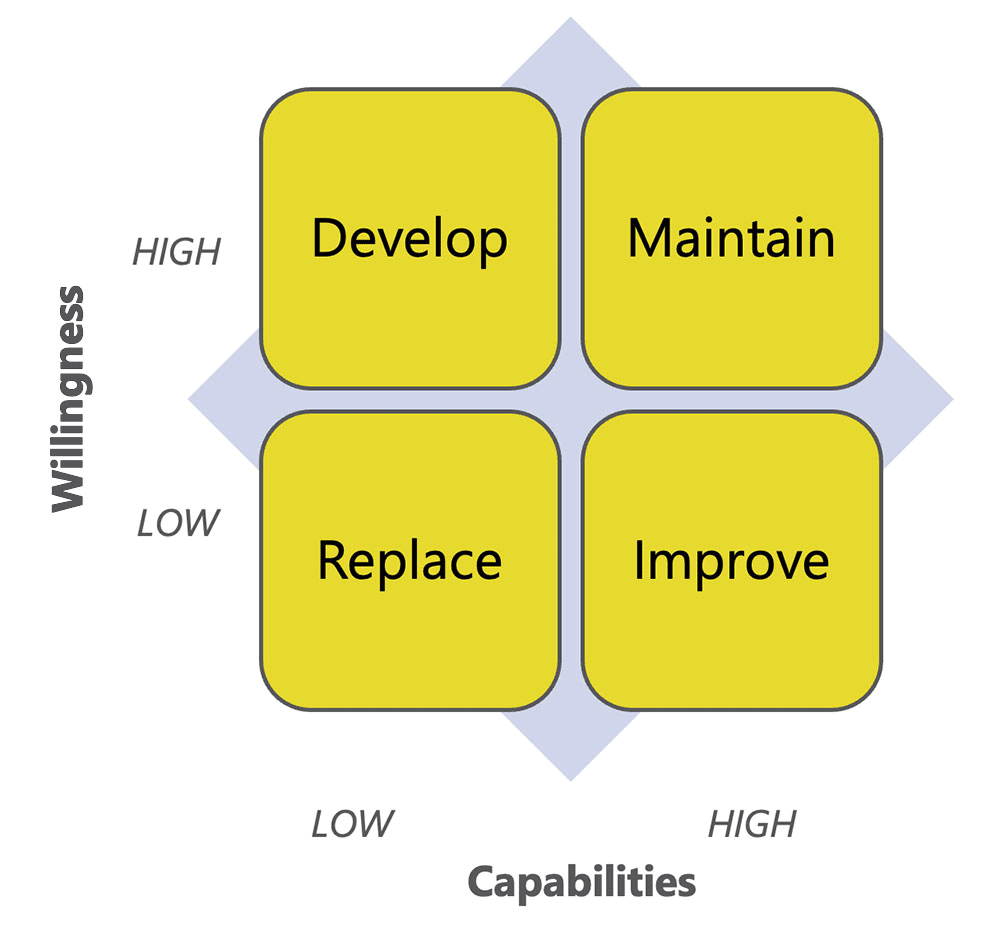

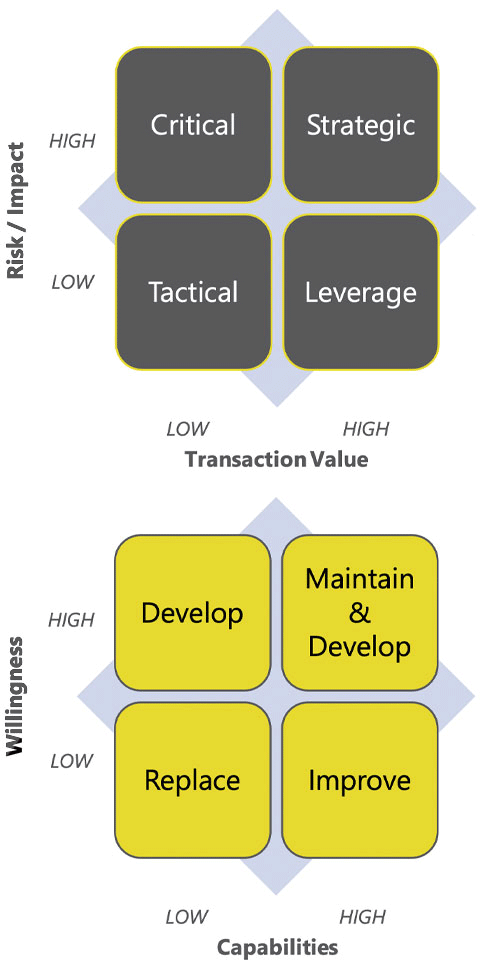

More recently though, a new approach to supplier segmentation called the Supplier Potential Matrix (SPM) was proposed, shown in Figure 4, right.

Basically, this method of segmentation focuses solely on the supplier characteristics and gives rise to 4 generic strategies which are more or less self-explanatory, while the PPM (Figure 2) focuses on the supply characteristics.

In this context capabilities (skills, knowledge, execution) and willingness (confidence, commitment, motivation to engage in a long-term relationship) have a set of individual criteria depending on the company in question.

Figure 4: Supplier Potential Matrix (SPM)

Both the PPM and the SPM methodologies have merit, and although fundamentally different, they can both improve the way suppliers are managed.

The final segmentation methodology to be discussed in this article is a combination of PPM and SPM, aptly called the SPM-SPM approach, conceptually shown in Figure 5 below:

Figure 5: PPM-SPM segmentation approach (concept shown for materials and services segmented as strategic)

How it works is that the PPM matrix is completed first, based on the risk / impact criteria selected, before each of the four categories: strategic, leverage, tactical and critical will have its own individual matrix based on supplier capability and willingness criteria, for the suppliers active in supplying the relevant goods and services.

Note that the four generic SPM strategies are potentially applied differently depending on which part of the PPM matrix is under consideration as shown in Figure 6 below. Of course, individual companies may have their own variations to the below.

| PPM Category | Recommended SPM Strategy |

|---|---|

| Tactical |

|

| Leverage |

|

| Critical |

|

| Strategic |

|

Figure 6: SPM strategies based on PPM categories

The challenge with the more detailed approaches (the PPM and the PPM-SPM) is that the time and effort spent on developing and maintaining these segmentations may be extremely prohibitive. The other challenge lies in evaluating across substantial amounts of qualitative data.

However, the developments in supplier management systems and big data processing, including AI, along with innovation in the supplier management are should in the not-too-distant future, be able to allow for complex supplier segmentation to be developed and maintained with much less manual input and processing. As an example, earlier this year (2021), a method involving fuzzy logic was developed and tested, with good results.

In the meantime, companies are recommended to employ the PPM methodology on their existing procurement profile, as a minimum basis for segmentation.

Alan Aastorp has built capabilities and delivered performance improvements for over 20 years, including engagements with some of the world’s largest companies, as well having professional qualifications in Supply Chain Management, Finance and HR. Alan can be reached at aastorp@productivity-lab.com.

References

Cips.org. (2019). Supplier Segmentation – The Chartered Institute of Procurement and Supply. [online] Available at: https://www.cips.org/knowledge/procurement-topics-and-skills/srm-and-sc-management/supplier-positioning1/supplier-segmentation/.

robertdavis17 (2020). How To Perform Supplier Segmentation And Increase The Value Of Your Supply Chain. [online] Prokuria. Available at: https://www.prokuria.com/post/how-to-perform-supplier-segmentation.

Procurement and Supply Australasia. (2021). Supplier Segmentation Using The Kraljic Matrix. [online] Available at: https://procurementandsupply.com/2021/03/supplier-segmentation-using-the-kraljic-matrix/ [Accessed 19 Oct. 2021].

Supplier Relationship Management (SRM) Redefining the value of strategic supplier collaboration. (2015). [online] Available at: https://www2.deloitte.com/content/dam/Deloitte/de/Documents/operations/Supplier_Relationship_Management_2015.pdf.

learning.edx.org. (n.d.). Course | edX. [online] Available at: https://learning.edx.org/course/course-v1:MITx+CTL.SC2x+1T2021/home [Accessed 19 Oct. 2021].

Rezaei, J. and Fallah Lajimi, H. (2018). Segmenting supplies and suppliers: bringing together the purchasing portfolio matrix and the supplier potential matrix. International Journal of Logistics Research and Applications, 22(4), pp.419–436.

Rajesh, G. and Raju, R. (2021). A FUZZY INFERENCE APPROACH TO SUPPLIER SEGMENTATION FOR STRATEGIC DEVELOPMENT. South African Journal of Industrial Engineering, 32(1).